How do repo find your car? The typical answer you get begins like “in many ways”. But this publication reveals the major ways the repo man finds you.

Repo finds your car by checking the addresses on your auto loan paperwork, contacting your references, spying on your social media activities, inspecting any paper trails linked to you. License plate scanners also make a good tool for the repo, and they can do a soft hit on your credit.

And do not quickly forget the credit application that you filled out, of course, you provided your contact information. The loan paperwork contains your name, address, email address, phone number, work information (company, employer, etc.), and references. Well, the repo will leverage these to find your vehicle.

What exactly does auto repossession mean?

A quick reminder, auto repossession is a legal act by your lender to reclaim or recover a vehicle when you are late or miss your monthly payment. The good thing is that some financial institutions do not immediately come after you, especially if you contact them to negotiate a way to make the debt payment easier.

The repo company is contacted by your lender to recover the vehicle. Remember that even though it is your vehicle, they have a lien on it. In essence, auto repossession is the first consequence for falling behind or failing altogether to make payments on an auto loan.

How do repo find your car?

In many ways and methods, the repo will find the vehicle, even if they not do find you. Below are the ways when you ignore your lender’s calls:

-

Cruise the addresses you filled out in the paperwork

Most of the time, the first place the repo is visiting to search for the car is your home address. They would cruise a visit to your home during the day and, and even at night in case you were out at day with the car.

Your job place is not spared, they would cruise to it severally, and even question whoever seems to be an employee there about you. Of course, they check the parking areas too, and if they spot the vehicle but on private property, they wait and follow you after you leave work.

It you penned your references’ addresses during the application, the repo man will visit them to check if you hid the vehicle there.

-

Your references

As if cruising your references’ addresses is not enough, your lender will continue to call them to turn you in. If you happen to have a bitter ex on the list, then you are busted.

The lender may never stop calling your references until it gets on their nerves. And if you have hidden the vehicle for a long time, some lenders will offer a reward for them to turn you in, perhaps, free gas at the pump.

-

Your social media

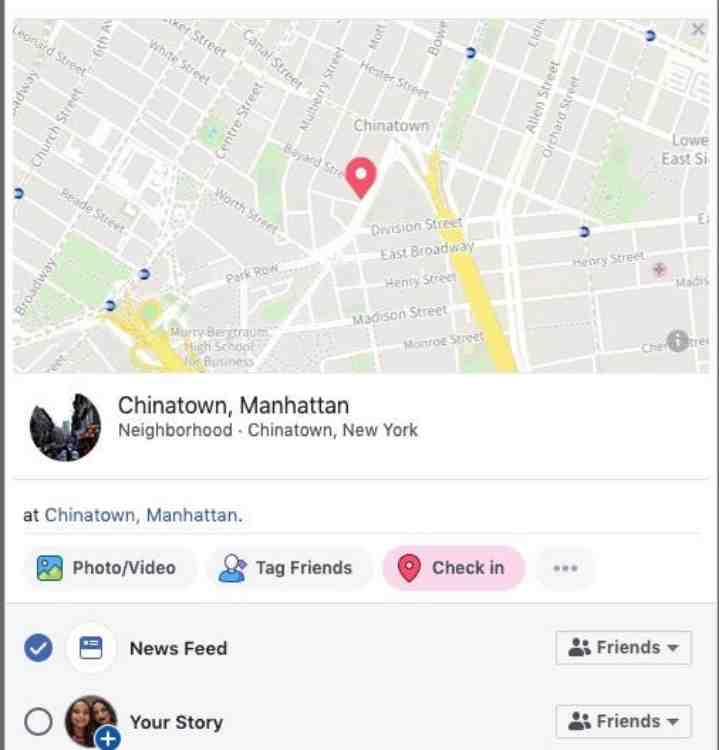

If you are one social of a human who loves making new posts about your movements, the repo can use that to find your car.

They will use your email address or even your phone number to find your social media profiles on platforms, including Twitter and Facebook. Your recent updates are what they are after, and if any hints at your current location, they are going to search and find you.

Perhaps, you want to be mindful of what statuses you put up. If you post stuff about visiting the local lake with friends during the weekend, you would be meeting the repo there.

Apart from coming after you, the repo may use your friends as bait. Your friend or someone who knows you may unknowingly give up your location.

-

License plate scanners

A repo company can find your car using license plate scanners. This scanner identifies the vehicles lenders try to repossess, and sends the data to their database.

The repossession company responsible for recovering the car may go through public parking lots scanning the license plates for retrievable vehicles. Repo outfits themselves with license plate cameras, and computers that help to find and match the location of vehicles, which are sent to various repo companies.

-

Paper trails

Paper trails of you can hint the repossession company about where to find you. When you apply for credit, you may be leaving a trail. Even your utilities reveal your exact location, leading the repo man straight to your doorstep.

If you recently paid your phone or electric bill, confirm if the listed address is any different from where you presently reside. Your question is “but how are they going to get the bills?” The answer is “well, anyhow they can”, and would make sure to obtain a copy.

-

Soft hits on your credit

A repo company can do soft hits on your credit to know if you recently applied for credit, changed your job or home address.

Soft inquiries on your credit report have nothing to do with you being lent more money but to check if you recently made any changes concealing your whereabouts from the repo.

Soft hits have no effect on your credit scores and are not also visible to potential creditors reviewing your credit report.

What should you do instead of hiding the car?

Hiding your vehicle from the repo or lender is not a slick thing to do, and you are merely hurting yourself. Understand also that hiding the vehicle is even worse on your credit history than voluntary surrender.

Hiding the vehicle can warrant a “Skip, Can Not Locate” (SCNL) on your credit report. And once this goes in your credit report, no lender may trust you again for the next few years, typically 7. This record simply tells a potential lender that you will fail to repay the loan or even hide from them.

So instead of hiding the car, make payment arrangements with your financial institution, or voluntarily surrender the vehicle.

Surrendering the vehicle is still a repo. However, you get a chance to explain to your next lender why you could not pay off the debt.

Final thoughts

The repo will get the car but even if they do not, hiding it from them can mess up your credit history. Moreover, you have multiple times to be lucky hiding from the repo while they only have to be lucky once.

And if you migrated to the island, perhaps, the repo will come after you for the vehicle. Do the math to figure out what could be more worth it for you.

FAQs

How long does the repo man look for a car?

The repo man looks for your car as long as they have to, and when they no longer can, you would get a Skip Can Not Locate on your credit history. Some would claim it takes the repo 30 days before they give up the search, but this is not always the case.

Can a repo man put a tracker on your car?

If necessary, a repo man can put a tracker on your car. Suppose a repo company is still finding your car. Repo agents locate vehicles for repossession using license plate scanners. Since the tow truck may not be readily available for the car, the repo man places a GPS tracker on it.