You want to know how to negotiate car repossession to protect yourself and, perhaps, the vehicle from being taken away. Of course, the credit effect can be damaging, and this publication will help you compose yourself out of it.

To negotiate a car repossession, evaluate the auto loan and contact your lender. Prepare to get back the vehicle, buy it back from the auction and consider reinstating the auto loan. A repo settlement is ideal to remove the debt record from your credit history.

If you win this negotiation, you get to manage the debt from spiraling out of control, and perhaps, retain the car. It is a worthwhile shot you want to give the lender to protect your credit history.

Can you negotiate repossession fees?

You can negotiate repossession fees or stop the vehicle repossession entirely. Besides, your lender dislikes the option of repossession and is willing to avoid it since it is expensive and time-consuming. The lender may be able to pause your repayment, lower the interest rate or even extend the grace period to make payments easier.

How to negotiate car repossession

This part of the publication discloses what you need to do to negotiate your way out of a car repo.

-

Evaluate the auto loan

The first thing you want to do is to determine the amount of money you still owe on the vehicle, and perhaps, estimate what you owe after a repossession takes place. Refer to your auto loan documents, and understand the terms and conditions of the loan. Meanwhile, here are the ways the repo men find your car.

-

Contact your lender

It always helps to contact your lender to find out how much you owe. Ask the lender for any available option or what you can do to recover the repossessed vehicle. You need to act even faster because once the repo man tows the car away, it could be heading to the auction.

The amount of money a dealer or buyer pays for the car at the auction is typically much less than the amount you owe. You are also liable for the remaining balance, which adds to your spiraling debt. For example, if you owe $15,000 on a car, it may be auctioned at $10,000 so you have $5,000 to pay off.

Play nice with your creditor, and get to speak with them yourself. Ask if they can work with you to reduce the payments or provide an option to help you pay the debt more easily.

Before you contact the lender, have an idea of the amount of money you can afford with your current payments. For example, if you just acquired a lump or have a new higher position, share the information with your lender. This tells the lender you have an improved financial situation after the repossession.

If your lender declines to work with you, consider hiring a debt settlement firm to handle the negotiations.

-

Prepare to get back the vehicle

The repo man or collection agent has your car, and you need to redeem it. Your finance company may allow you to buy back the vehicle, which is referred to as redeeming. However, you have to pay the full balance plus fees.

You need a record of any information relating to the car repossession. This would include the amount of money you owe on the car and the repossession date, where the auction will take place, a record that shows when the car will be sold, and the proposed auction amount.

In many states, the lender must notify you about their intention with the car. This includes the auction location and date so that you can bid on the car. If your lender has not already notified you, request it from them.

-

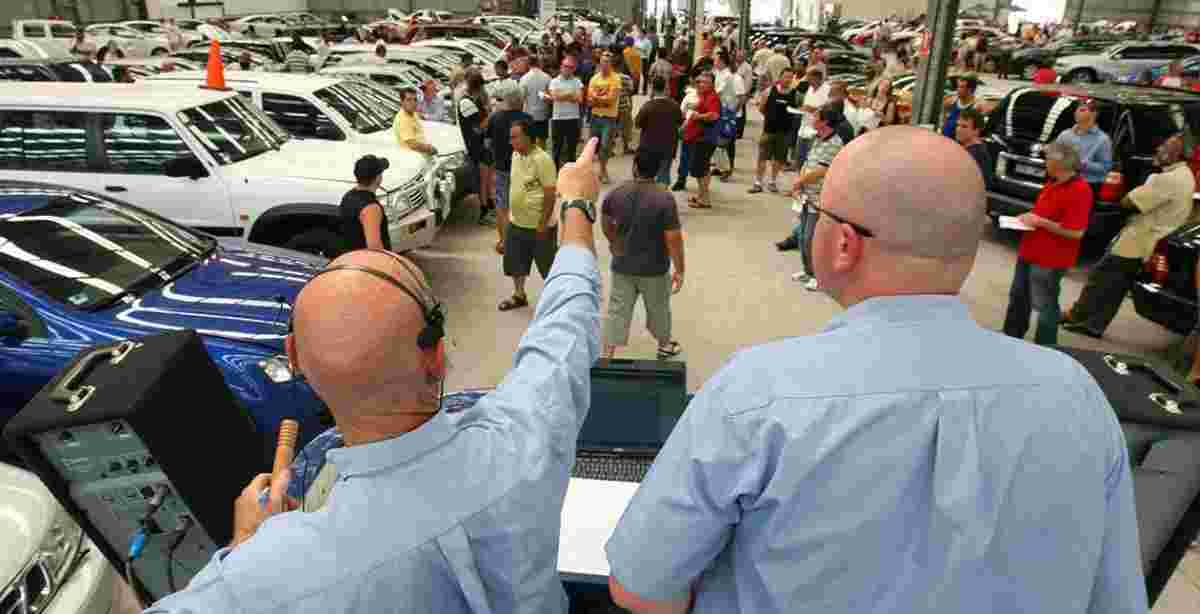

Buy back the repossessed car at the auction

Depending on your state, the financial company should send you a notification stating where and when the car will be auctioned. Although you would be bidding on the vehicle, do not expect a better deal.

After winning the bid, you still have to pay the auction price, past due, remaining balance, and, perhaps, fees. You should also consider buying the car directly but you need the complete cash to buy the car directly from the auction.

Bidding on the vehicle may get you to win it back for less money. However, you are still responsible for the balance you previously owed, so it makes no difference. The lender will deduct the amount for which the car is auctioned from the pending balance. And any remaining balance is on you.

Additionally, you have to make the payments until you pay off the balance, which goes on your credit report. Car repossession remains on your credit report for 7 years.

-

Reinstate the loan

Make a deal with your lending company and pay your past-due amount plus the repossession fees for a second chance. The payments must be timely, or the lender will send a new wave of repo men to repossess the car.

Depending on the lender, a tracking device may have to be installed in the vehicle before you can reinstate your auto loan. This helps them to track and repossess the vehicle faster when you are late or miss a payment.

Read also: A non dealer can bid at the auctions

FAQs

Can I settle on a repo?

You can settle on a repo. Settling your debt can help to clear repossession charges on your record. If you hire a debt settlement company, they will negotiate with your lender to lower the amount of money you owe.

Should I pay off a repossession?

You should pay off a repossession on your record to help your credit score, and reduce the debt you owe. The effect on your credit score will depend on your credit history, profile, and whether you take a settlement.

Can I negotiate with the repo man?

You do not negotiate with the repo man repossessing your car, you cannot smooth-talk them into going against their client’s (your lender’s) instructions. Moreover, a repo man is not authorized to accept your payment for restitution. Contact your lending company to negotiate the car repossession.