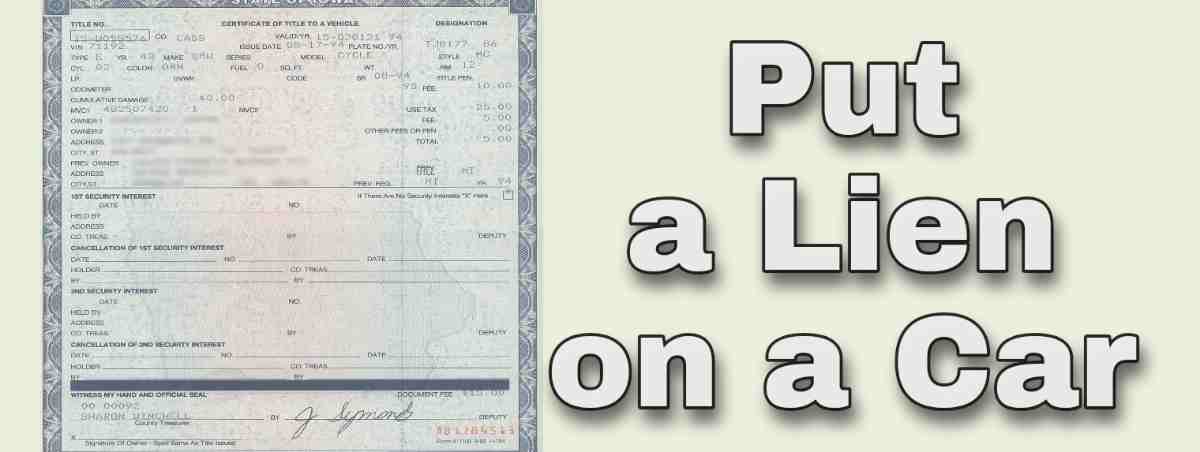

If a car owner is indebted to you, then putting a lien on the car might be an option. Therefore, you will learn how to put a lien on a vehicle in this article, following the lawful steps.

When you place a lien on a car, it reflects on the car ownership, making the car title become collateral. The lien you put on a car also prevents a debtor or the car owner from selling it. Even if they attempt to sell the car, the buyer will request the lienholder to sign over the title. Moreover, the motor vehicle agency won’t register the car in the name of the buyer, except the buyer agrees to complete the debt.

When putting a lien on a car, you want to refer to the laws of your state through your DMV’s website. You will also notify the car owner to complete their debt.

Can I Put a Lien on a Vehicle that I’m Selling?

Yes, you can put a lien on the vehicle you’re selling, but the initial lienholder must approve of it after you make full payment. However, if you’re putting a lien on your debtor’s registered car, you will follow the legal process after some time to sell the car and recover your debt. In some states, if selling the car does not cover the debt, you can report the debtor to the collection. Meanwhile, can a tow company send someone to the collection?

To sell a vehicle after putting a lien on it In Texas, your reasons must be convincing to the court. For example, your reason can be that the debtor defaulted on the loan or a mechanic’s lien for unpaid repairs.

If you’re put a lien on another person’s car as a private individual, you need court-ordered judgment to put a lien on the car. Some organizations or licensed individuals with access to the personal property registry may not require a court order.

Getting court approval depends on the situation, sometimes the amount of money owed is a factor. The most common scenario is when the car owner breaches a contract and refuses to show up in court. If the contract is well-defined, the judge can give a judgment to put a lien on the car. Note that the court would have exhausted several avenues, such as notifying the car owner, before the lien approval.

However, if the car owner has grounds to contest the contract breach, it can take several weeks to months to get a judgment.

How to Put a Lien on a Vehicle

You can’t wait already to become the lienholder of your debtor’s car. Well, it’s an easy procedure and below are the steps regarding how to put a lien on a vehicle:

-

Find Out About Your State Laws

The first step is to find out about your state laws on putting a lien on the car, especially as a private individual. The simplest way to reach your state laws on this is to search “car lien law + [state name]”. The best resource is your state’s website because you may have to download the application form and check your eligibility.

In the meantime, let’s continue with the procedure so you know what it looks like. You will need a few legal documents required by your state obtainable from online (your state’s website) or the courthouse.

In California, for example, the requirements for putting a lien on a vehicle are governed by civil code section 3110. You have to file the preliminary notice in 20 days. Regarding the lien in California, you’re to “file it earlier than 90 days from the completion of the service or 60 days from the recording of the notice of completion”.

In New York, you serve the lien in 5 days before filing it and 30 days after the filing of the preliminary notice.

-

Notify the Party Involved

As mentioned in legal requirements, similar in all states, you’ll notify the debtor within 10-20 days after delivery of service, depending on your state.

Ensure to enter the correct name(s) and address(es) of the individual(s) and include details of the transaction and services you offered. You should itemize applicable charges; otherwise, the debtor might write you to send them an itemized list of the charges.

-

File the Lien

When the debtor responds to the notice, take it up from there. If the owing party does not respond, file a lien after the period required by the state elapses. You may be required to complete one or more court forms.

-

File Foreclosure Suit

If the debtor responds to the lien, the court will fix a date for you and the debtor to show up. And if the debtor does not show up, you win. If the debtor does not pay with your lien on the vehicle, file a foreclosure suit to enforce the payment.

Filing a foreclosure charge typically has a deadline you must meet so that the lien does not become invalid. If the lien becomes invalid, the car owner is not obligated to pay the debt.

Can You Put a Lien on a Car that is Abandoned in a Parking Lot?

Yes, you can put a lien on a car abandoned in a parking lot. In Oklahoma, it is known as ‘Title 42’ lien. A junkyard, impound lot, mechanic, etc., use them to put a lien on vehicles. Nonetheless, a private individual can activate the lien on the vehicle of “interest”.

Final Thoughts

In some states, putting a lien on a car requires minimal paperwork. You may be able to download the required paperwork online from your local DMV or state’s website.

When you have your paperwork ready, notify the car owner and make your claim in court. As mentioned earlier, your claim must be valid. It can be a claim on property damage, non-payment on work done, etc. The process is even easier if the car owner or debtor ignores the notification and fails to contest the lien. Meanwhile, you may be interested in the steps to remove a name from a title.

![5 Ways To Make a Fake Car Insurance Card 2025 [Tutorial] 5 Ways To Make a Fake Car Insurance Card 2025 [Tutorial]](https://sanedriver.org/wp-content/uploads/2020/09/fake-car-insurance-card1-1-211x150.jpg)

![How to Get a Salvaged Title Cleared [Complete Guide] How to Get a Salvaged Title Cleared [Complete Guide]](https://sanedriver.org/wp-content/uploads/2020/10/1604064840122-211x150.jpg)